Ship’s Condition Inspection Backed Valuation Surveys & Certification

Ship and vessel valuation surveys are considered an important aspect during a vessels life cycle, and are tricky and arduous engagements to accomplish, often requiring a combination of skills including seafaring, financial and statistical capabilities, irrespective of the size and type of the vessel, or the purpose for which the valuation is carried out.

Having completed, to date, over 150 valuation

assignments, Constellation Marine Services are

extremely well placed to offer unparalleled

services in this regard, and we remain unbiased,

independent, and objective in our findings and

results.

While we understand the underlying objective

of a valuation survey is to arrive at an assets

Fair Market Value, we also believe there is

more than one approach in arriving at this,

and therefore we utilize an accepted and systematic

approach combined with a standard mechanism

to determine the value of the ship or vessel.

This is particularly true when the factors

affecting a ships value are considered, including

but not limited to Market conditions, sentiments,

supply and demand statistics, age and remaining

economic useful life of the vessel being valued,

design specifications, and last but not the

least, the vessels maintenance, upkeep and performance.

For sale and purchase, and those that include

willing buyers and sellers, this model adds

considerable support to their decision making,

and generally removes ambiguities and assumptions

that would otherwise arise due to the asset

not physically inspected, including assurances

that the value will remain same post a specific

date of the valuation.

Contrary to popular belief, ships can be

valued at any stage of their life cycle, including

New Buildings, for ships in operation, for ships

in pre contract stage, during refurbishment

and upgrading or during their end of life cycle

such as demolition.

The valuation process involves numerous stages,

and generally starts with receipt of client’s

information, and may often lead to either a

desktop valuation, or proceed to a physical

condition survey including an onboard assessment

of the condition of the vessel.

The process will then progress to a Market

study and data collection of a price idea, analysis

and calculation of the vessels useful remaining

economic life, to arrive at a fair market estimation,

further to which an analysis of replacement

cost and sale comparison is made to determine

the vessels value reconciliation.

A physical evaluation of the condition itself

has numerous stages, including the vessels overall

examination of its hull structure, fittings,

machinery, class and statutory status etc, with

a perspective to gauge their availability, functionality

and maintenance condition, and thereafter summarize

and finalize the physical condition survey findings

for the benefit of the valuator.

An evaluation thereafter is made for Market

indicators such as Spending / Capex availability,

asset utilization, freight, and charter rates

to determine operability, statistics on situation

for new orders and scraping (supply and demand)

etc.

An assessment thereafter is made with regards

to the vessels effective age and economic useful

life, where factors such as comparison with

an asset of like kind, the duration of profitable

use, the assets overhaul and rebuild status.

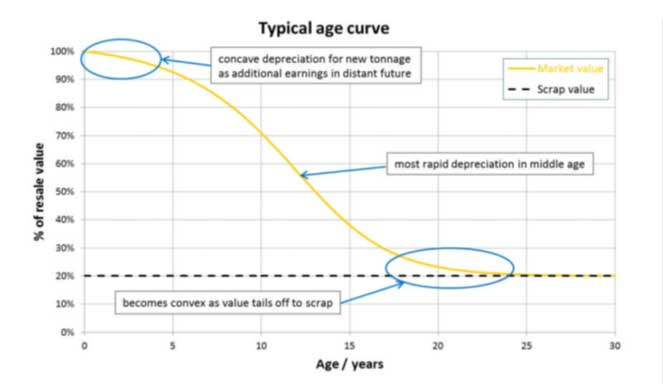

Comparisons to typical vessel age curves is thereafter evaluated, and historically compared with those populated by industry leaders, such as the one from EXIM bank extracted for the year 2019, appended below, as an example:

In certain cases, and as for specific purpose vessels, a Sales Comparison approach may also be considered, where simply put, the value of the asset may be determined by analyzing recent 2nd hand sales (offered sales prices) that are similar in nature and type to the asset being valued. This methodology provides a value overview for “specialized crafts” such as high-speed passenger ferries, dynamic positioned offshore assets, diving support vessels, specialized chemical, and gas carrier vessels.

The process thereafter arrives and culminates to the value reconciliation stage, where comparisons and gaps (if any) between the various approaches are made reliable by either seeking more data on the vessel or the adopted approach, or if the gap is narrow, considered less uncertain to state a Fair Market value. A standard market accepted Statement or certificate of Valuation is thereafter issued, with stated emphasis on the valuation date.

The process thereafter arrives and culminates

to the value reconciliation stage, where comparisons

and gaps (if any) between the various approaches

are made reliable by either seeking more data

on the vessel or the adopted approach, or if

the gap is narrow, considered less uncertain

to state a Fair Market value.

A standard market accepted Statement or certificate

of Valuation is thereafter issued, with stated

emphasis on the valuation date.

Constellation Marine services can be contacted at any time for your valuation needs and we would be more than happy to provide a service that we are certain will meet and exceed your expectations by our team of Chief Engineers, Master Mariners, and Naval Architects.

Constellation Marine services can provide an unbiased valuation service, may it be for sale & purchase, security or mortgage, court sales and legal disputes or for Insurance and risk underwriting, through in house proprietary resources that include Chartered engineers & Valuators, Naval architects, Marine Chief engineers and Master Mariners.